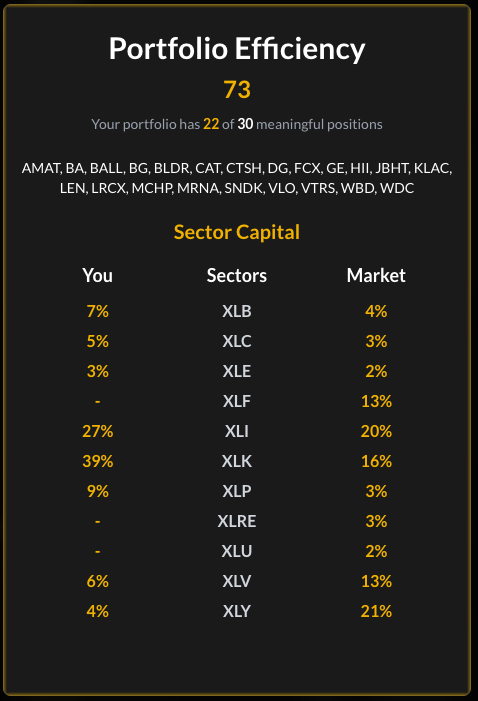

Portfolio Efficiency

Accessible via the Pie Chart Icon on your My Portfolio dashboard, this card grades the structural health of your portfolio.

1. The Metrics

Efficiency Score

The large number at the top (e.g., 73) is your Efficiency Score.

- Goal: Aim for a score of 100.

- Calculation: This scores how well you are balancing your capital across the S&P 500 sectors compared to the market benchmark.

Meaningful Positions

Below the score, you see a count (e.g., "22 of 30 meaningful positions").

- Meaningful: A position is considered "meaningful" if it represents a significant enough portion of your portfolio to matter. Buying $1 of a stock won't count here.

- Target: We encourage building a portfolio of ~30 solid positions to achieve proper diversification.

2. Sector Capital Comparison

The table provides a clear breakdown of your exposure vs the Market (S&P 500).

- You (Column 1): The percentage of your cash allocated to each sector.

- Sectors (Column 2): The 11 GICS sector codes (e.g., XLK for Tech, XLV for Health Care).

- Market (Column 3): The benchmark allocation.

How to use this:

- Identify Gaps: If the Market has 20% in Industrials (XLI) and you have 27%, you are "Overweight."

- Find Openings: If you have 0% in Financials (XLF) but the market has 13%, you might want to look for opportunities there to balance your score.