My Portfolio

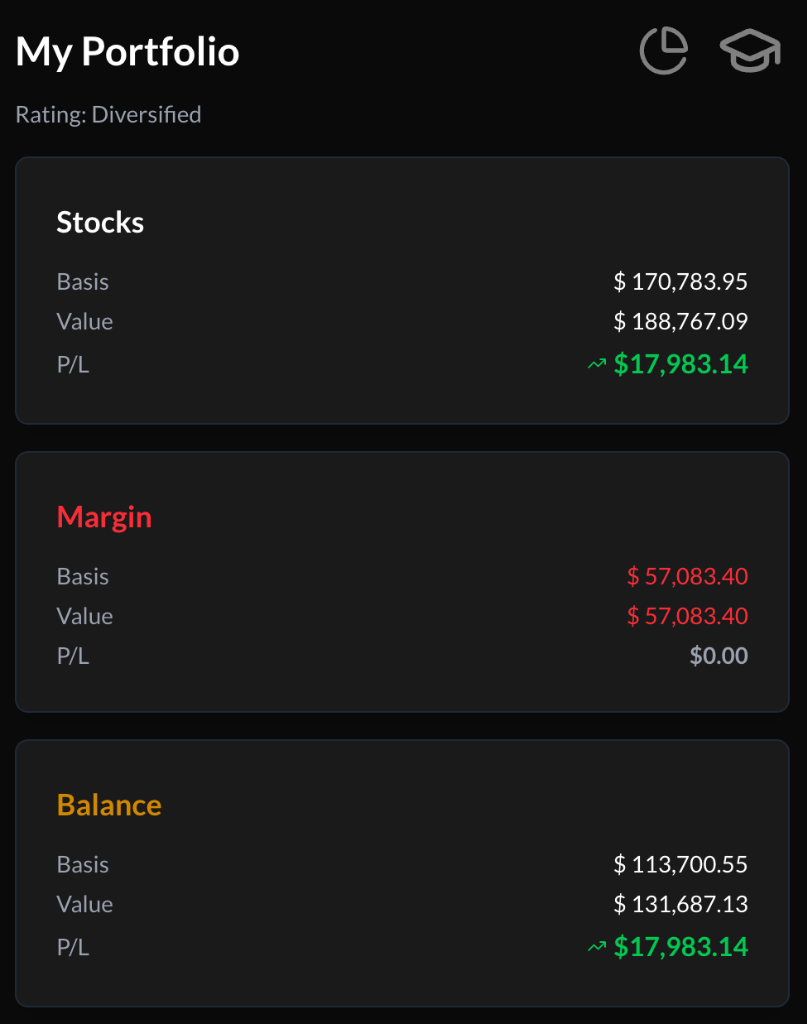

The My Portfolio section provides a high-level view of your financial standing. It is organized into three subsections, which we call Shells.

The Shells

Each shell displays your Cost Basis, Market Value, and the resulting Profit / Loss for that specific component.

1. Stocks Shell

This displays the aggregate value of your stock holdings.

- Efficiency Focus: We only assess the 503 stocks in the S&P 500. This ensures we focus on liquidity and efficient portfolio building rather than "chasing tickers."

- Fractional Shares: You can buy fractional shares for as little as $1.

2. Cash Shell

This shows your available cash.

- Margin Indication: If your cash status is displayed in Red with the label "Margin," it indicates you are currently using margin.

3. Balance Shell

This is the summary shell. It sums the Cost Basis and Market Value from the Stocks and Cash shells to show your total portfolio standing.

MarketQuants is powered by Alpaca. While you can use the app for free to view the Leaderboard, you must create an Alpaca account to unlock the full system, including trading and portfolio management.

Portfolio Structure & Ratings

MarketQuants analyzes your portfolio composition to give you a "Health Rating" based on your Ticker Count and Sector Exposure.

The Rating Logic

| Ticker Count | Sectors | Rating | Goal |

|---|---|---|---|

| 0 | 0 | Undecided | Get Started |

| 3 to 8 | < 3 | Speculative | Diversify Positions |

| 9 to 17 | 3+ | Concentrated | Identify Themes |

| 18 to 35 | 3+ | Diversified | Sustain Structure |

| 36 to 44 | 3+ | Losing Focus | Avoid Dilution |

| 45+ | 3+ | Overbuilt | Restore Balance |

Visual Indicators & Navigation

- Rating: The header displays a rating (e.g., "Diversified") indicating how we assess your portfolio structure.

- Icons:

- Pie Chart Icon: Links to your Portfolio Efficiency analysis.

- Hat Icon: Links to Quant School, where we publish educational video content.