Information Cards

The Information Cards provide deep fundamental data and historical performance context for a ticker.

How to Access

You can open these cards by tapping the "Hidden Gem" (blank space) on a Leaderboard Tile or the Trading Cards header.

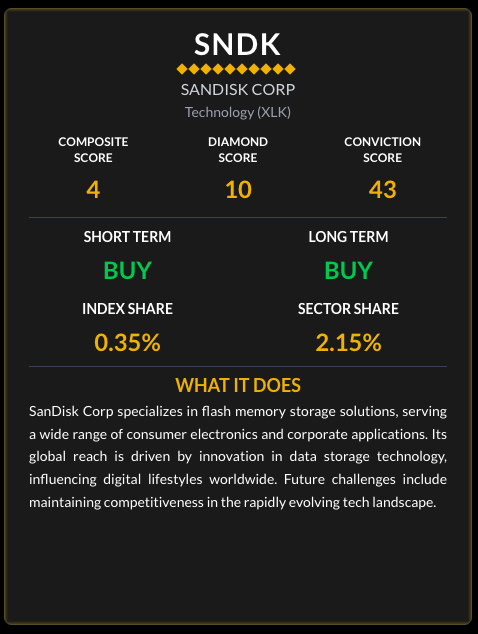

1. Ticker Overview

The first card gives you a clear, fundamental picture of what you are buying.

The Scores

We display our three proprietary MarketQuants scores directly at the top:

- Composite: The overall master score.

- Diamond: Our premium "scarcity" score (0-10).

- Conviction: The strength of the trend.

Ratings & Shares

Below the scores, you'll see key metrics:

- Short Term / Long Term: Buy/Sell ratings based on our algorithmic timeframe analysis.

- Index Share: The percentage weight this company holds in the overall index (e.g., S&P 500).

- Sector Share: The percentage weight within its specific sector.

What It Does

We believe you should KNOW what you are buying. This section provides a concise summary of the company's business model and products.

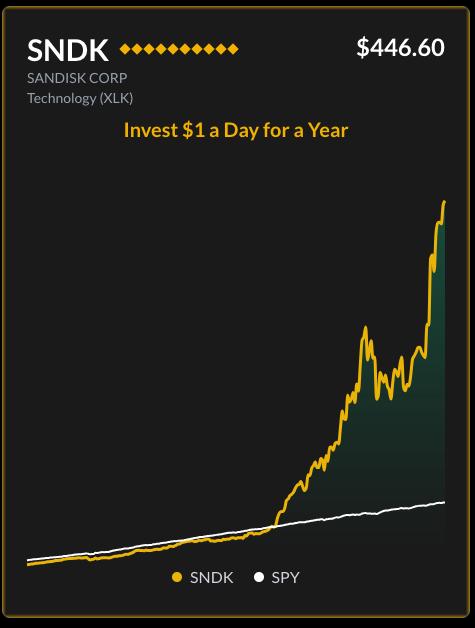

2. Growth of a Dollar (vs Market)

Swipe Left-to-Right from the Overview to see the performance comparison against the broad market.

- The Concept: "If I invested $1 a day for the last year, how would I have done?"

- Yellow Line: The ticker's performance (e.g., SNDK).

- White Line: The market's performance (Index/SPY).

- Insight: This helps you visualize if the asset is beating the market average over time.

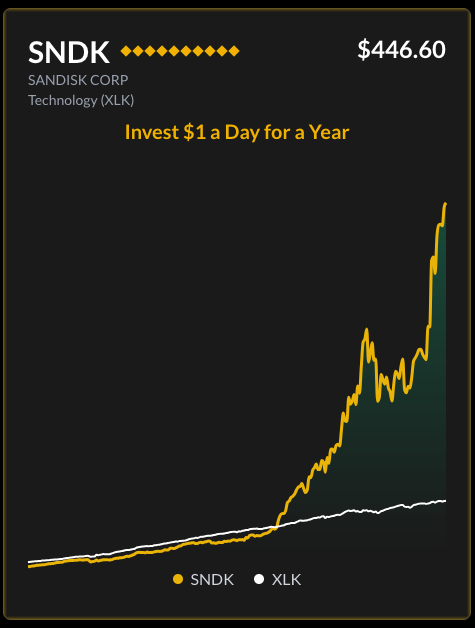

3. Growth of a Dollar (vs Sector)

Swipe Left-to-Right again to compare against the sector peers.

- Sector Comparison: Compares the ticker against its specific Sector ETF (e.g., XLK for Technology).

- Why it matters: A stock might be beating the market but lagging behind its own sector competitors. This chart reveals that relative strength.

Navigation

- Next Card: Swipe Left to Right (or tap the grey dots) to move through the cards (Overview -> vs Market -> vs Sector).

- Close Card: Swipe Right to Left to close the cards.

- Tap Outside: Tap the dark overlay area to close.